Transforming Finance Education Through Interactive Trading Simulation

Kulnicha Meechaiyo

and Ruslan Tuneshev

University of St Andrews

Published February 2025

Abstract

This study explores the transformative potential of interactive trading simulations in finance education, focusing on their implementation in a UK higher education context. The Portfolio Management module at the University of St Andrews incorporates a simulation where students work in teams to manage a virtual portfolio, bridging theoretical knowledge with real-world financial decision-making. Each team member takes on a specific role—analyst, strategist, portfolio builder, or trader—similar to the responsibilities in real fund management. Students found this method helpful for understanding complex ideas, gaining practical skills, and building important qualities like teamwork, digital skills, and leadership. This approach makes learning more engaging and practical, preparing students with the skills they need in the future.

Introduction

Finance is a widely studied program in UK higher education, but it presents challenges as students must comprehend and understand complex mathematical models and academic theories. While educational simulations are known to enhance learning experiences through active engagement, there has been little research focused on their application in finance education within the UK.

Integrating computer-based simulations into course assessments enhances student engagement by shifting their perception from viewing simulations as games to recognizing their educational value. This approach has proven effective, as evidenced by students producing detailed reflections on their learning, trading outcomes, and understanding of finance concepts. Selecting the right simulation software is crucial and requires robust technical support to ensure smooth operation, particularly in light of potential issues like internet instability. Additionally, preparing alternative assessment options as backups can help prevent disruptions and ensure that simulations run smoothly, thereby supporting students' learning even when technical problems arise (Marriott et al., 2015).

Sharma et al. (2018) further illustrate this by aligning their study with experiential learning principles, placing students in a “real-time” environment that connects theory with practice through direct trading experiences. While the technology and small class settings effectively engage students, there remains potential to improve inclusivity in larger classes, especially for introverted learners. The study also emphasizes that students find the experience significantly useful; however, areas such as networking could be enhanced to better support real-world applications.

Alshurafat et al. (2020) also utilize case studies and real-life scenarios in forensic accounting assessments, covering aspects like fraud examination, evidence collection, report writing, problem-solving, and the role of expert witnesses. One notable case study involved three students collaborating to investigate various types of digital evidence in fraud cases, enabling them to develop essential skills and knowledge by simulating real forensic accounting tasks. A university website outlines how these case studies are integrated into forensic accounting courses, emphasizing that such simulations enhance students' understanding of the subject and improve their job prospects. Practitioners highlight the importance of seeing evidence of practical or simulated experience in students' education.

However, the transition from traditional teaching methods presents challenges, making students uncomfortable despite the new approach's benefits. This method promotes teamwork, develops complex problem-solving skills, and facilitates the application of theories to real-life situations. Additionally, it helps students understand their learning processes and fosters greater independence (Matzembacher et al., 2019).

In the rapidly changing finance landscape, practical experience is essential. In our finance module, we’ve created a learning experience that simulates real-world trading environments, where students act as fund managers. They collaborate in teams to manage a virtual portfolio, applying theoretical knowledge to real-time market conditions.

What did we do?

In the modern world of finance, direct experience is crucial for grasping the complexities of portfolio management and investment strategies. In the Portfolio Management module, we created a group project where students can encounter the real challenges and decisions that fund managers face. This project highlights the importance of teamwork and responsibility while simulating the challenging environment of financial markets.

This simulation is a free virtual stock exchange game that anyone can participate in. It is not part of any software or university program, and no costs are involved (which is an attractive feature). The money is virtual, so no real capital is at risk.

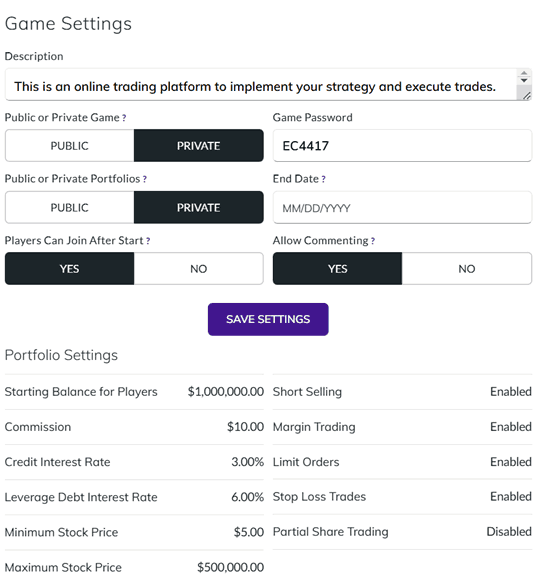

Other attractive features are that you trade stocks in real time using tools/instruments that are also available to those who trade using real money. These tools/instruments include leverage, stop loss/limit orders, buying on margin, etc. As far as I am aware, there are no limitations in terms of how many students can participate. If other lecturers want to create a similar simulation, all they need is to go to the website (https://www.marketwatch.com/games), click on Create game, register an account and then choose the game settings (i.e total virtual budget, min/max price of stocks available for trading, availability of stop loss orders, buying on margin, credit/borrowing and lending rates, etc). After this, students start trading and you can see their performance. All in all, the procedure of creating this simulation is very easy, straightforward, free and available to anyone. As a lecturer, I find that this platform can support a large number of students; however, there are some limitations, such as asset restrictions (only U.S. stocks and funds) and the lack of advanced financial instruments such as options, futures, forex, and commodities.

In our finance module, the group project allows students to form a team of fund managers, each with specific duties, aiming to deliver consistently high risk-adjusted returns for investors. A team consists of an analyst, a strategist, a portfolio builder, and a trader. This actively managed fund requires the team to select and execute an active investment strategy based on US stocks to maximize risk-adjusted returns. The fund starts with an initial balance of $1,000,000, and margin trading is available. Students can buy or short any US stocks and stock indices through the simulation broker, the MarketWatch platform.

Screenshots of game settings

The structure of the project mirrors a real-world fund management team, with clear responsibilities divided among team members:

- The analyst’s job is to identify and specify the fund’s objectives and constraints, discuss current market conditions and form capital market expectations.

- The strategist’s job is to propose an investment strategy that is in line with fund’s objectives and constraints as well as market expectations presented by the analyst. The strategist’s role is also to clearly define asset allocation and explain the main rationale behind the profitability of selected strategy.

- The portfolio builder’s job is to develop a portfolio optimization technique, determine security selection and asset allocation steps according to the proposed strategy and market analysis prepared by the analyst.

- The trader’s job is to execute the trades in real markets consistently with the chosen strategy and implement security selection and asset allocation steps. Trader should also describe the trading constraints/limitations and suggest/exploit performance evaluation measures relevant for the constructed portfolio.

What did students see?

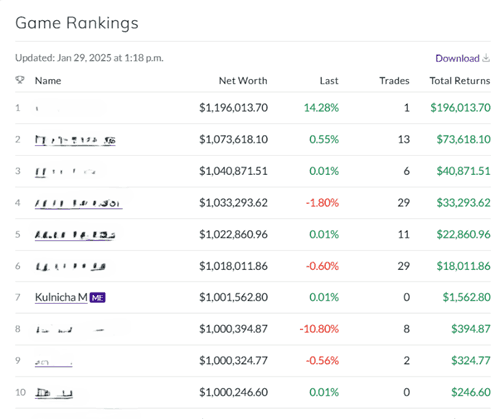

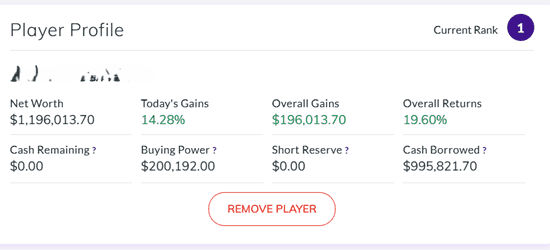

Students can see the game rankings, and we also join them without trading. This allows students to compare their profit gains from trading with the deposit rate. Students' trading strategies remain private, so they feel more comfortable using their own strategies. In addition, students can access general information such as net worth, overall gains, and overall returns.

Screenshots of game ranking and player profile

Students' feedback

Students responded positively to the nature of the trading simulation, highlighting how it complemented the theoretical knowledge covered in the module. Here are some of the key comments from students:

"The module was very practical, and this was especially aided by the trading project. It allowed me to apply what we learned in class in a real-world scenario, making the concepts much easier to grasp."

"This is a realistic module with direct applications to the job market. The skills presented here were well received because of the clear translation to the real world. I can see how these activities reflect what I would be doing in a professional setting."

"This module has substantially enhanced my research skills, especially through the group project. It provided me with a strong understanding of portfolio management, showing how financial institutions make decisions. I also found exploring different trading strategies very interesting and useful for my future career."

These reflections emphasize the impact of the simulation in helping students connect classroom learning to practical, real-world financial decisions. The classroom experience helped them develop skills that are directly transferable to the finance industry. The feedback from students highlights the important graduate attributes developed through the trading simulation in the module. Students found the module valuable, appreciating how the trading project helped them make complex concepts easier to understand. They noted that the module had skills such as teamwork, digital literacy, and leadership that clearly translate to professional activities. In addition, the group project significantly improved their research skills, giving them a solid understanding of portfolio management and how financial institutions make decisions. Exploring different trading strategies was described as interesting and valuable for their future careers.

Overall, these reflections show how the simulation helped students connect classroom learning to real financial decisions, equipping them with essential skills in valuing diversity, leadership skills, and an entrepreneurial mindset for success in the finance industry.

Conclusion

In conclusion, the integration of computer-based simulations in finance education significantly develops the learning experience by effectively bridging the gap between theoretical knowledge and practical application. The trading simulation implemented in our Portfolio Management module has demonstrated its capacity to engage students actively and facilitate their comprehension of complex financial concepts. Feedback from students underscores the value they place on the practical nature of the module, which enables them to apply classroom learning to real-world scenarios. This pedagogical approach fosters the development of essential skills, including teamwork, digital literacy, leadership, and research proficiency, thereby equipping students to navigate future challenges within the finance industry. Ultimately, the simulation not only enriches the educational experience but also cultivates the graduate attributes necessary for success in their professional careers, promoting an entrepreneurial mindset and a commitment to valuing diversity in today’s dynamic financial landscape.

References

Alshurafat, H., Beattie, C., Jones, G., & Sands, J. (2020). Perceptions of the usefulness of various teaching methods in forensic accounting education. Accounting Education, 29(2), 177-204. https://doi.org/10.1080/09639284.2020.1719425

Chulkov, D., & Wang, X. (2020). The educational value of simulation as a teaching strategy in a finance course. e-Journal of Business Education and Scholarship of Teaching, 14(1), 40-56.

Marriott, P., Tan, S. M., & Marriott, N. (2015). Experiential learning: A case study of the use of computerised stock market trading simulation in finance education. Accounting Education, 24(6), 480-497. https://doi.org/10.1080/09639284.2015.1072728

Matzembacher, D. E., Gonzales, R. L., & do Nascimento, L. F. M. (2019). From informing to practicing: Students’ engagement through practice-based learning methodology and community services. The International Journal of Management Education, 17(2), 191-200. https://doi.org/10.1016/j.ijme.2019.03.002

Sharma, S., Charity, I., Robson, A., & Lillystone, S. (2018). How do students conceptualise a “real world” learning environment: An empirical study of a financial trading room? The International Journal of Management Education, 16(3), 541-557. https://doi.org/10.1016/j.ijme.2017.09.001

↑ Top