How to invest optimally in a market

Home » Educational resources » By subject » Advanced Econometrics and Quantitative Techniques » St Andrews PhD seminars

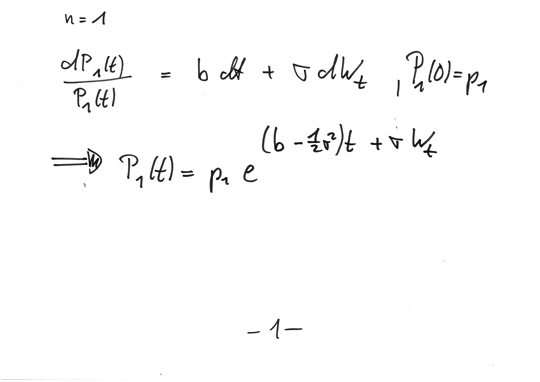

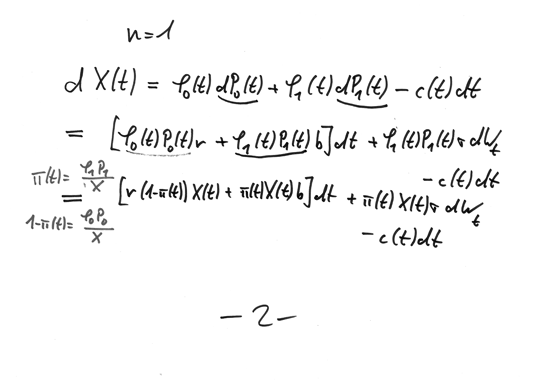

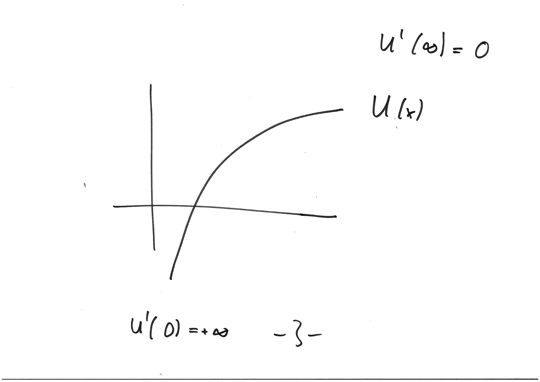

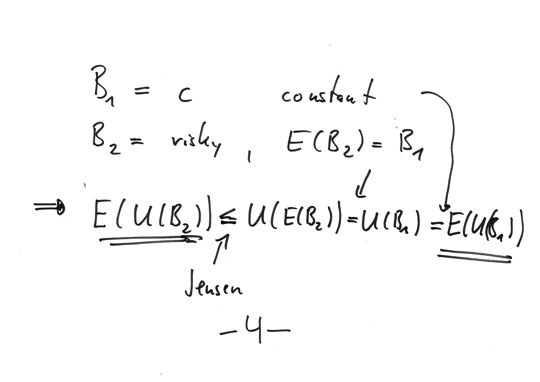

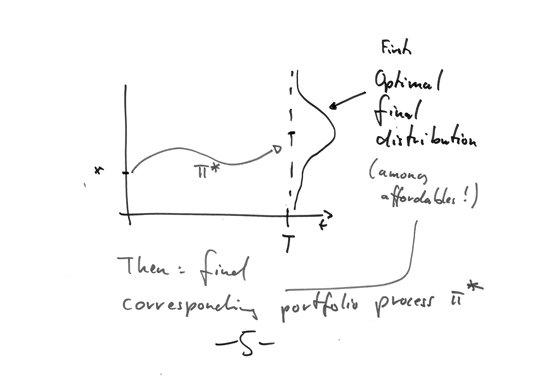

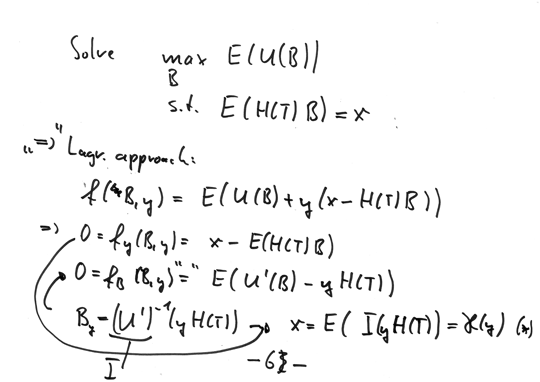

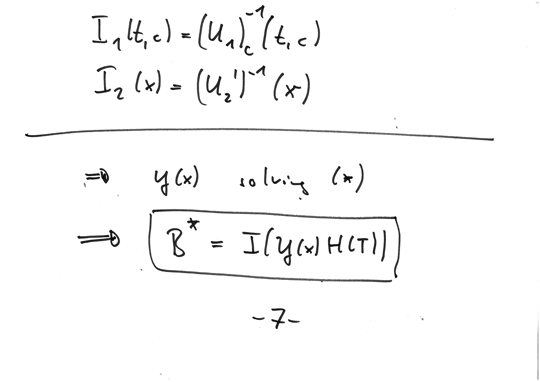

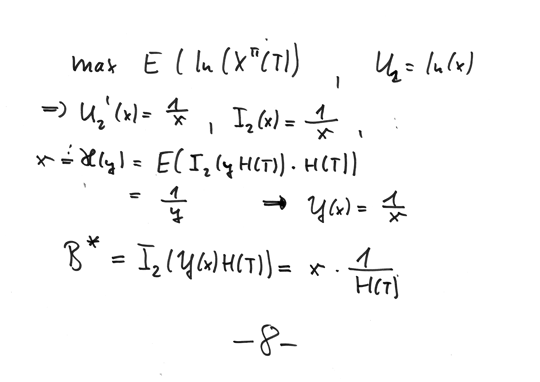

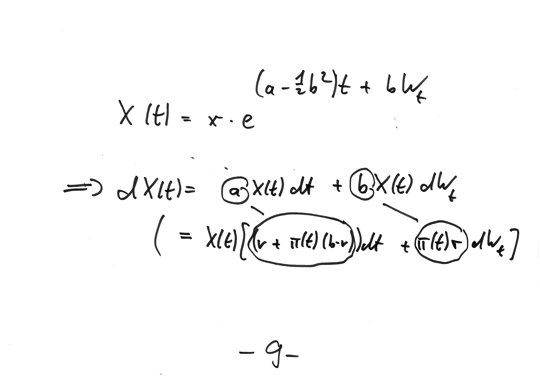

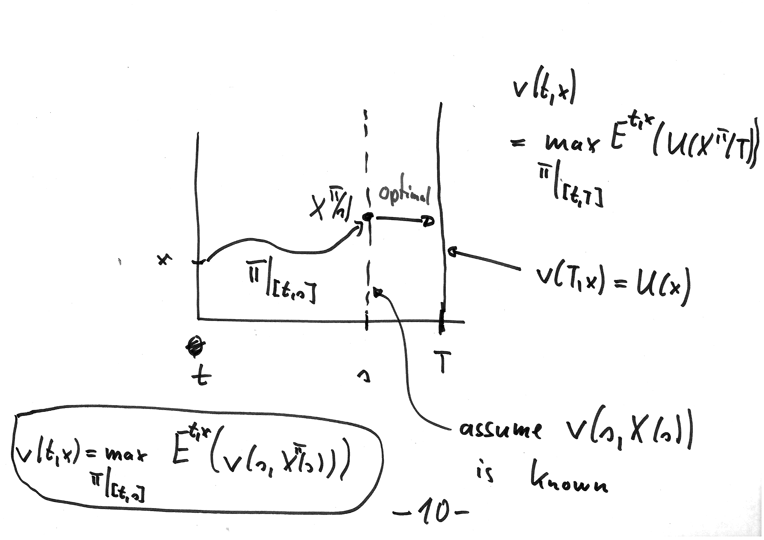

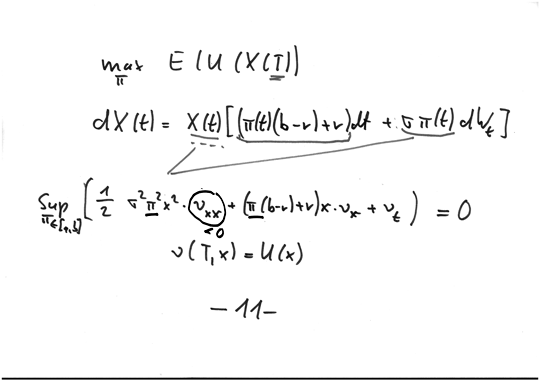

This set of talks was given on 28 November 2008 as part of the PhD seminar series organised by the School of Economics & Finance of the University of St Andrews. Prof Ralf Korn speaks about modern portfolio optimization techniques and how real traders apply them. He includes topics such as Defaultables and Market Crash hedging, which in current times of credit crunch and sub prime crisis is extremely relevant. The mathematical techniques used for that sort of modelling are explained in detail.

Slides in PDF format: morning session and afternoon session.

Video can be downloaded here in MP4 format: Morning part 1 (53 minutes), Morning part 2 (33 minutes), Afternoon part 1 (41 minutes), Afternoon part 2 (41 minutes).

About the Speaker

Professor Ralf Korn is Dean of Mathematical Sciences at the University of Kaiserslautern (Germany). His main areas of research are in financial mathematics (portfolio optimization, transaction costs, modelling of inflation, dividends and longevity) and stochastic control (control of continuous-time stochastic processes with applications in finance, worst-case-control). He is the Associate Editor of "Mathematical Methods of Operations Research" and the Associate Editor of "Mathematical Finance".